This is calculated annually on the date your fixed-rate period started. You can make additional payments during the fixed-rate period without incurring an early repayment charge . Anything over the 10% will incur an ERC, which is a charge you may have to pay if you repay the whole or part of your mortgage early. This includes if you move to a different HSBC mortgage rate, or move to a different lender during your fixed period. Mortgage and home equity products are offered in the U.S. by HSBC Bank USA, N.A. Discounts can be cancelled or are subject to change at any time and cannot be combined with any other offer or discount.

Summary of the features and terms of our home loan products. Building a house is a very time-consuming and often stressful event in your life. Make sure your HSBC Premier Construction Home Loan allows for all of these finishing touches, and ensure there is enough money available for the unexpected and for any finishing details. Whether you're buying a new home or looking to refinance your existing home loan, we have a home loan suited for you.

Hsbc's Other Products

HSBC, being one of the finest institutions, facilitates you with the HSBC Home Loan so that you can easily plan and make your dream of buying a house come true. HSBC provides home loans at an affordable interest rate which starts from 8.35% and floats according to your employment status which can be Salaried, Self-employed or Balance Transfer Loans etc. HSBC issues loam amount starting ranging from INR 3 lakhs up to INR 40 crores with a repayment tenure of up to 25 years in case of a salaried person and INR 20 years for a self-employed individual.

Default-insured borrowers saw fixed rates sink as much as 30 basis points on some terms this week. The lowest rates on one-year to five-year insured terms are now all below 5 per cent again, thanks partly to competitive discounters such as QuestMortgage. Urban Money is India’s one of the unbiased loan advisor for best deals in loans and unmatched advisory services. We manage the entire borrowing process for clients, starting by assisting our clients to choose the right product from the appropriate lending organization,till the time, the entire loan is disbursed. This factor plays a vital role in deciding the interest rate against the loan amount. Similar is the case with new and old properties, where new properties attract lower interest rates and old properties attract higher interest rates.

HSBC Premier

Household debt stood at around 24% of financial assets and 87% of disposable income by June 2022. These indicators remained largely in line with their average since June 2009. The study analysed new loans issued between the fourth quarter of 2020 and the second quarter of this year, and subjected them to interest rate hikes of up to 250 basis points. The data comes from a Central Bank of Malta study that analysed the impact of higher interest rates on borrowing costs for households.

For Fixed Rate Home Loan2as below up to 25% of the loan amount sanctioned in every financial year NIL. With effect from 01 Dec' 22, the applicable Marginal Cost of Funds based Lending Rate (M.C.L.R.) will be as follows. Since July, the interest rate for the main refinancing operations rose to 2%. The ECB’s Survey of Professional Forecasters for the fourth quarter of 2022 suggests the MRO rate will rise steadily to 2.6% by the first quarter of 2023 and stabilise at around 2.7% until 2024.

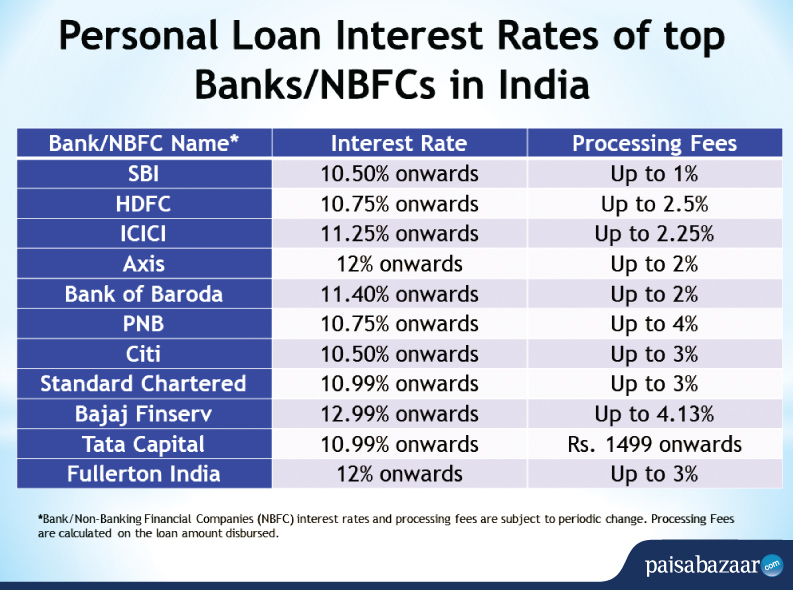

Home Loan by Top Banks

Full or partial loan repayment before term is allowed without any early repayment fee. Settle your loan faster – in fewer years and make interest savings through our exclusive fortnightly repayment option. If such change is to your disadvantage, you may within 60 days of the notice, close your account without having to pay any prepayment charge. Up-to 1% fees on amount above 25% of the SHCF/SLCF sanctioned amount. On the balance amount maintained over and above the Threshold.

The 3 month MCLR is published by the Bank at the beginning of every month, which will be the benchmark rate for loans that are disbursed in that month. The floating rate of interest on all the loans disbursed by the bank will be reset at an interval of 3 months from the month of loan disbursal. It will be reset against the 3 month MCLR published by the bank in the month of reset. The reset will be done by the 7th calendar day of the month. (Refer to the example below.) A revision in the applicable rate of interest will lead to a revision in the Equated Monthly Instalment or the loan tenure at the bank's discretion.

From and against any losses, claims and/or liabilities incurred by Citibank NA as a result of having relied on such information. Is not required to verify the information provided by the applicant and neither is the bank obliged to provide the applicant with any loans or credit facilities based on the provided information. This page is not, and should not be construed as, an offer, invitation or solicitation to buy or sell any of the products and services mentioned herein to such individuals. Lending criteria and HSBC Premier eligibility criteria apply. Interest rates are subject to change or withdrawal without notice. Please refer to Wealth and Personal Banking Fees and Charges.

Yes, HSBC checks for CIBIL score for Home Loan and considers 750 and above as an optimum value and gives the customers with this much score a great deal in interest rate and loan amount. You must have your income proof, i.e. the last 3-6 months salary slip as asked by the bank. Repay your loan sooner and save on total interest paid with our fortnightly repayment option. We would not be bound by a month's notice for change in interest rates or any charge levied as a result of regulatory requirements.

Consider your financial goals whether you are taking your first step to buy your home, investing in additional residential properties, or looking to lower your existing home loan repayment by refinancing it with us. You should know the home loan interest rate is offered by keeping into mind your age, income, property value, property location, credit history, professional stability. If your profile covers all these factors, your chances of getting lower rate increases. You don’t have to use your savings because you can apply for a home loan. The rate offered on HSBC Bank home loan is very low which means you can pay EMIs within your budget and continue earning interest on your savings parallelly. In this article, we have brought in the crux of home loans offered by the bank.

This rate is applicable only for Balance Transfer/Balance Transfer + Top-up. Top up of more than 150% of the base loan will be priced at a premium of 50 bps. Rates, discounts and loan amounts depend on specific program and may require certain personal deposit and investment balances, reserves, equity and automatic payment from an HSBC U.S. checking account.

The RLLR will be published by the Bank at the beginning of every month and it will be the benchmark rate for RLLR linked Home Loans that are disbursed in that particular month. The floating rate of interest on all the loans disbursed by the Bank will be reset when there is a change in the policy repo rate by RBI. The reset will be done by the 7th calendar day of the following month from RBI’s announcement of change in repo rate. A revision in the applicable rate of interest will lead to a revision in the Equated Monthly Instalment or the loan tenure at the Bank’s discretion. The applicable rate of interest rate on your loan is the RLLR plus the margin . 5The prepayment charges are applicable only during the fixed rate tenure.

Listening to what you have to say about our services matters to us. We can help if you're looking to buy a second home or considering borrowing more money against your property. Find the home loan that's right for you, whether you're downsizing or buying a more expensive property.

All loans are subject to the documentation, applicable credit policies and compliance of legal requirement of HSBC. Listed below are the basic documents required, for more details please speak to your Relationship Manager or visit the nearest HSBC branch. The option to change your Equated Monthly Instalment up to 15% higher or lower is not available in the last Equated Monthly Instalment year.

I hereby acknowledge and agree to allow Citibank to share my details with any UAE credit bureau and make enquiries about me with any UAE credit bureau at its sole and absolute discretion. Citibank Terms and Conditions apply, are subject to change without prior notice and are available upon request. For the current Terms and Conditions, please visit our website All offers are made available on a best-effort basis and at the sole discretion of Citibank, N.A. Citibank, N.A. Makes no warranties and assumes no liability or responsibility with respect to the products and services provided by partners/other entities.

No comments:

Post a Comment